what do need to fill out for llc business paperwork

A sole proprietorship is the simplest and most common type of business organization, but it's also the riskiest. Every solar day that you run your business, your personal assets are on the line.

Every bit your concern acquires employees, property, and assets of its own, it makes sense to carve up your personal life from your business life. Forming an entity such as a limited liability company, or LLC, shields your personal assets from business debts and liabilities.

Let's take a look at the concern documents required to gear up up an LLC.

Overview: What'south an LLC?

An LLC is a legal business entity formed by one or more owners, known as members. Unlike a sole proprietorship, an LLC has rights, responsibilities, debts, and assets separate from those of its owners.

An LLC is a relatively simple business organization structure, with profits from the concern passing through to the members' personal income based on their share of ownership. Any number of members may elect to create an LLC, and members may be added or removed as the concern grows.

Benefits of forming an LLC

There are iii major advantages of forming your business as an LLC.

1. Limited liability

A principal motivation for forming an LLC is to shield yourself from legal and financial liability for your business. As a sole proprietor, your personal assets may be seized to satisfy business debts or legal judgments. Forming an LLC protects your personal property and income from those risks.

2. Laissez passer-through income

The profits from an LLC are passed through to the owners' personal income for tax purposes, just as they are with a sole proprietorship or partnership. This is simpler to manage and generally results in lower taxes than corporations.

LLCs may elect to exist taxed as S corporations instead, giving owners tremendous flexibility in managing their tax burdens.

3. Agile ownership

An LLC may be managed solely past its members or by anyone appointed to serve as manager. This gives you the flexibility to retain control and actively manage the business in whatever way you'd like.

The 7 documents y'all need to create an LLC

The post-obit summarizes the documentation requirements for creating an LLC. Depending on the nature and location of your business organization, you may be able to skip one or more than steps.

1. Internal Revenue Service (IRS) Class SS-iv

If you don't already have one, yous'll need to obtain an Employer Identification Number (EIN) for your business via IRS Form SS-4. You can download the form to file by mail, or merely apply online and receive your EIN immediately.

Your EIN is used on revenue enhancement forms and other official documents to place your business organization.

2. Name reservation application

Before filing any LLC formation documents, you will need to cull a name for your LLC and run an availability search to determine if information technology's already taken. You tin unremarkably run a proper name availability search on the website of the secretary of country or corporations agency.

Generally, states have specific rules for ensuring that a concern name differs plenty from those of existing businesses to qualify.

For example, Utah specifies that using a plural form of a word is non enough to distinguish one business name from another. If the name "Mad Insubordinate" is taken, you cannot cull "Mad Rebels."

Besides availability, yous must bank check whether your name is permissible. Each state has unique naming rules including prohibited and restricted words.

In Utah, for example, you cannot apply the give-and-take "Thrift" in a concern name without requesting permission from the Department of Financial Institutions. Each country as well has specifications for including corporate designators such as LLC in your business name.

Once y'all take a viable proper name, you may file a name reservation form with your land (though information technology'southward not required) to concur it while you file your LLC paperwork.

You can usually detect all of these materials on the secretarial assistant of state website.

three. Manufactures of organisation

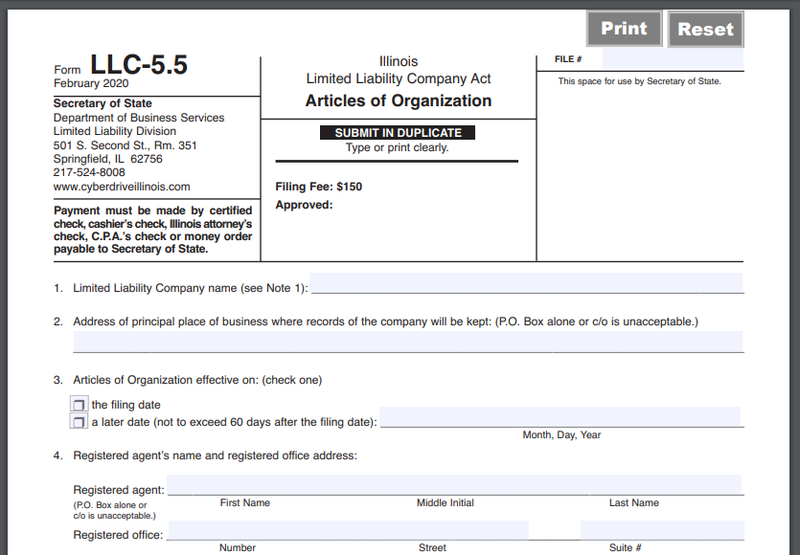

To form your LLC, y'all must submit to the land articles of organization, also called a certificate of organization (or certificate of germination in some states). You lot tin generally download the advisable grade from the secretarial assistant of state website.

When filing your form, brand sure to include the correct number of copies. Oft, you lot're required or permitted to submit two copies, ane for the land to proceed and one to postage stamp and return for your records. Failing to include the prescribed copies is a common crusade of rejected filings.

Each state has its own requirements, but articles of organization generally include the following:

- Business organisation name: Be sure to write your full, legal concern name exactly as it must appear co-ordinate to your state's rules.

- Business purpose: Some states require a specific purpose, while others allow you lot to state broadly that your business will appoint in lawful concern activities. For example, in Illinois, professional LLCs must state the specific professional person services they will appoint in.

- Duration: Some states ask you to specify whether your LLC has a dissolution engagement. A few states set a statutory limit on the duration of an LLC, but in most cases, you may designate your agreement as perpetual.

- Primary business address: This is the concrete location that serves equally the base or headquarters of your concern operations.

- Buying: Your agreement must list all members of your visitor with full contact information. You will likewise need to indicate what share of the business concern each member owns.

- Management: Your agreement must specify whether your LLC is managed past its members or past designated managers. Names and full contact information for all managers must be provided.

- Registered amanuensis: Your concern must appoint a registered agent who is available during regular business organization hours to accept delivery of notices of lawsuits, known as service of process, and other official documents. There are companies that provide professional registered amanuensis services for a fee.

Each state provides forms for articles of organization, similar this i for an Illinois LLC.

4. Operating agreement

An operating agreement, also known as a visitor agreement, establishes the ground rules for running your LLC and the rights and responsibilities of its members. It besides confirms how profits and losses will be distributed amidst them. Unremarkably, members receive profits as income based on their share of ownership.

Operating agreements are not ordinarily required by states every bit part of the formation process, but they are essential for establishing how your LLC will exist governed. All members must sign the document to validate the agreement.

If you desire to write your own operating understanding, you can discover samples online, but since this is the legal foundation of your business, it makes sense to go input from legal counsel before signing. Generally, operating agreements include the following:

- Business name and address

- Registered agent accost

- Germination engagement and duration

- Member names, roles, and contact information

- Contributions and shares of buying

- Distribution of profits and losses and bounty plans

- Managing director names and contact information

- Coming together schedules and voting rights of members

- The procedure for adding or removing members

5. Initial and annual reports

States need to have accurate, upwards-to-appointment records on businesses operating within their borders. To maintain them, near states require LLCs to file periodic reports to confirm basic data almost their operations.

States use a wide range of names for these reports, including annual reports, statements of information, franchise tax reports, business entity reports, and annual certificates.

They are ofttimes due annually or biennially following the year of formation, but in some cases, they're due less oft. Pennsylvania, for example, collects them every ten years.

A few states, including Alaska, California, Nevada, and Washington, require LLCs to file an initial report or argument of information at the time of LLC registration.

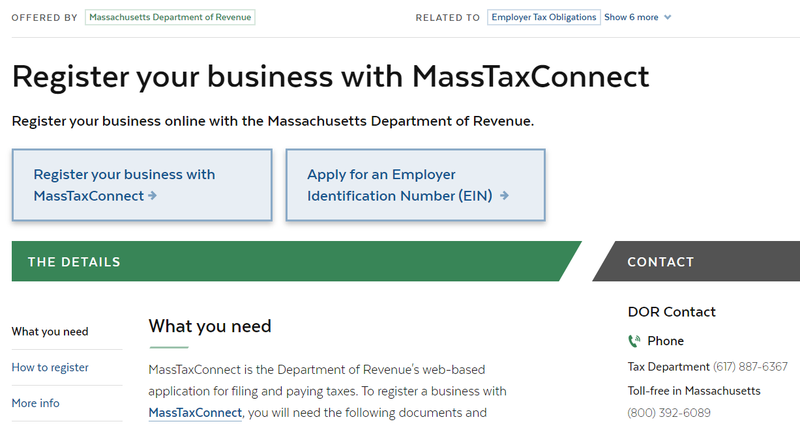

6. Revenue enhancement registrations

In many states, your LLC will need to annals with the department of revenue for one or more than tax types. These may include full general business entity taxes, employer taxes, and sales and use taxes.

Usually, tax registration requirements and forms are included with business germination resources in the state'south business portal.

Most states include tax registration in their concern formation resources.

7. Business organization licenses

Depending on the nature and location of your business, you may demand one or more than business licenses. Typical licenses for small businesses include the following:

- Dwelling house occupancy permits

- Premises permits for features such as signs, warning systems, and elevators

- Licenses for regulated activities such every bit food preparation and daycare

- Professional licenses for services such as engineering and architecture

In near cases, y'all can use for licenses online through the state corporations division.

With all of these documents, it pays to be meticulous. Missing a detail can outcome in rejected paperwork, sending yous back to start over and delaying your blessing. Getting audio legal and fiscal advice as y'all form your business is a wise investment.

Yous should retain founding documents for the life of the business. A certificate management system tin simplify the process tremendously.

Set your business up for success

Forming an LLC is a major milestone in your company'south growth. It marks the beginning of your business as a split up entity from yourself, with assets, liabilities, and responsibilities of its own.

Brand information technology official the right way, with conscientious paperwork and a plan for future filings that meets all of your state's documentation requirements.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may accept an involvement in companies mentioned.

Source: https://www.fool.com/the-blueprint/llc-documents/

0 Response to "what do need to fill out for llc business paperwork"

Post a Comment